who pays sales tax when selling a car privately in ny

The license plate should be returned to PennDOT at Bureau of Motor Vehicles Return Tag Unit PO. Register and title the vehicle or trailer or snowmobile boat moped or atv or transfer a registration from another vehicle.

Private party sales within most states are not exempt from car tax but unlike dealer transactions the seller does not collect the car tax.

. Car Sales Tax for Private Sales in New York Private sales are also subject to the 4 state sales tax. Warranty fees see page 15. Who Pays Sales Tax When Selling A Car Privately In Florida Form 1181E Download Fillable PDF or Fill Online.

When a dealer sells a motor vehicle to a resident of New York State the dealer must collect sales tax from the customer unless the sale is exempt see Part X. Do not let a buyer tell you that you are supposed to. License plates and registrations buyers must visit a motor vehicle service center to register a vehicle for the first time.

The dealer must reveal on the sales contract when a passenger car had been used primarily as a fleet car. Download this image for free in High-Definition resolution the. However if you bought it for 14000 and sold it for 15000 earning a 1000 capital gain you would report this on your tax return using Schedule D on Form 1040 thats appropriately titled.

The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle. Who pays sales tax when selling a car privately. Youll pay the 6625 percent state car sales tax when you bring the title to.

Once you have purchased the vehicle from a private party you are responsible for paying the state sales tax to the New York State DMV. The buyer will have to pay the sales tax when they get the car registered under their name. If i sell my car do i pay taxes.

Register and title the vehicle or trailer. When a dealer sells a motor vehicle to a resident of New York State the dealer must collect sales tax from the customer unless the sale is. Once the buyer has the vehicle registered under his name he must pay to sell Texas.

Transportation and destination charges. It ends with 25 for vehicles at least 11 years old. If the VIN doesnt match have the seller correct it before you buy the car.

Box 68597 Harrisburg PA 17106-8597. It might sound obvious but a lot of people forget to check. Once the lienholder reports to flhsmv that the lien has been satisfied.

You have to pay a use tax when you purchase a car in a private sale. The tax due in is called use tax rather than sales tax but the tax rate is the same. The sale price of the vehicle.

As for this case it all comes down to. Contact Us Today To Sell Your Car For Cash. Ad We Coordinate Pick Up Make The Selling Process As Easy As Possible.

While this question might seem a little complicated the answer is very straightforward and the simple answer is you dont have to pay taxes. Florida gives a sales tax credit on a purchase when you trade in so if you buy out your current lease pay sales tax on it and then trade it in to carvana and purchase a new vehicle from carvana you will save 1900 on the sales tax on the purchase of the new vehicle. The seller must indicate the mileage of the vehicle in the appropriate spaces provided on the ownership document.

The state where you pay vehicle registration fees is the one that charges the sales tax not the state where you made the vehicle. When a vehicle is sold in a private sale both the buyer and the seller must fill out a Statement of Transaction form DTF-802 which is then submitted to the New York DMV where the sales tax is calculated and collected from the buyer. Provide other acceptable proofs of ownership and transfer of ownership.

Sign the bill of sale even if it is a gift pay sales tax or have proof of an exemption. Vehicles which are gifts are exempt from sales tax. However you do not pay that tax to the car dealer or individual selling the car.

The average total car sales tax paid in New York state is 7915. Understanding Taxes When Buying And Selling A Car Cargurus who pays sales tax on private car sale is important information accompanied by photo and HD pictures sourced from all websites in the world. Determining how much sales tax you need to pay depends on your home states laws and the state in which you bought the car.

After the title is transferred the seller must remove the license plate from the vehicle. Make sure the vehicle identification number VIN on the title matches the VIN on the car. Who pays sales tax when selling a car privately Uncategorized February 7 2021 Uncategorized February 7 2021.

Instead the buyer is responsible for paying any sale taxes. The bill of sale must indicate whether the vehicle is new used reconstructed rebuilt salvage or originally not manufactured to US. Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax.

So if you bought the car for 14000 and sold it for 8000 you would have a capitol loss of 6000. Sales taxes for a city or county in New York can be as high as 475 meaning you could potentially pay a total of 875 sales tax for a vehicle in. You will pay it to your states DMV when you register the vehicle.

Yes you must pay sales tax when you buy a used car if you live in a state that has sales tax. Ad Receive Car Selling Tips Pricing Updates New Used Car Reviews More. That single missing digit voided the title.

Mllcb42 June 14 2021 324pm 3. You typically have to pay taxes on a car received as a gift in illinois. The dealer must provide the buyer with odometer and salvage disclosure statements.

This important information is crucial when youre selling. Complete and sign the transfer ownership section of the title certificate and. You would not have to report this to the IRS.

The amount subject to tax includes all the following items. When you buy a car from a private seller you dont pay any sales tax to them. As of 2020 New York has a car tax rate of 4 percent plus local taxes whereas next-door neighbor Massachusetts has a state car tax rate of 625 percent with some local rates much higher.

Sign a bill of sale even if it is a gift or.

Selling A Used Car In Ontario How To Get It Right Clutch Blog

Car Tax By State Usa Manual Car Sales Tax Calculator

Selling A Used Car In Ontario How To Get It Right Clutch Blog

Is It Illegal To Ship Something To Another State To Avoid Sales Tax Quora

Texas Used Car Sales Tax And Fees

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Dealer Fees You Should Know When Buying A Car Credit Karma

Car Tax By State Usa Manual Car Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

Selling A Used Car In Ontario How To Get It Right Clutch Blog

Selling A Used Car In Ontario How To Get It Right Clutch Blog

Maryland Car Tax Everything You Need To Know

Car Tax By State Usa Manual Car Sales Tax Calculator

Selling A Used Car In Ontario How To Get It Right Clutch Blog

Selling A Used Car In Ontario How To Get It Right Clutch Blog

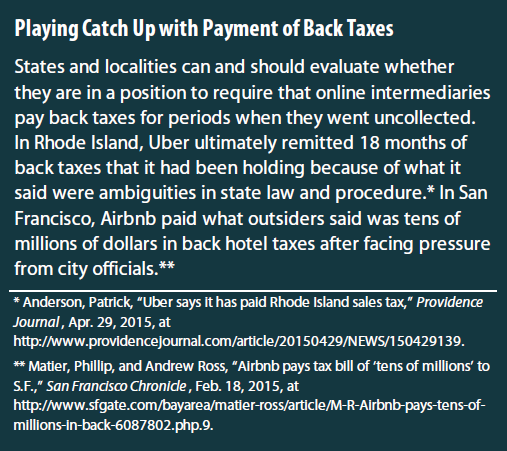

Taxes And The On Demand Economy Itep

Selling A Used Car In Ontario How To Get It Right Clutch Blog

:max_bytes(150000):strip_icc()/buying-a-car-in-a-different-state-4148015-Final2-1a901895477c4c518d48407644568ce8.png)